Solar Loans

Overview :-

Solar Loan FAQ

- What is a solar loan?

A solar loan is a financial option that allows homeowners and businesses to borrow money to purchase and install solar panels. This loan can cover the cost of solar equipment, installation, and other related expenses.

2. What are the benefits of taking a solar loan?

- Cost savings: Reduce electricity bills by generating your own power.

- Environmental impact: Contribute to reducing carbon footprint and promoting renewable energy.

- Increase in property value: Solar panels can increase the resale value of your property.

- Tax incentives: Take advantage of government incentives and tax credits for solar Installations.

3. Who is eligible for a solar loan?

Eligibility criteria may vary by lender, but generally, applicants need to:

- Be property owners.

- Have a good credit score.

- Provide proof of income.

- Have a property suitable for solar installation.

4. How much can I borrow through a solar loan?

The loan amount varies based on the cost of the solar system and the lender’s policies. Typically, loan amounts can range from 3 lakh to 50 lakh rupees.

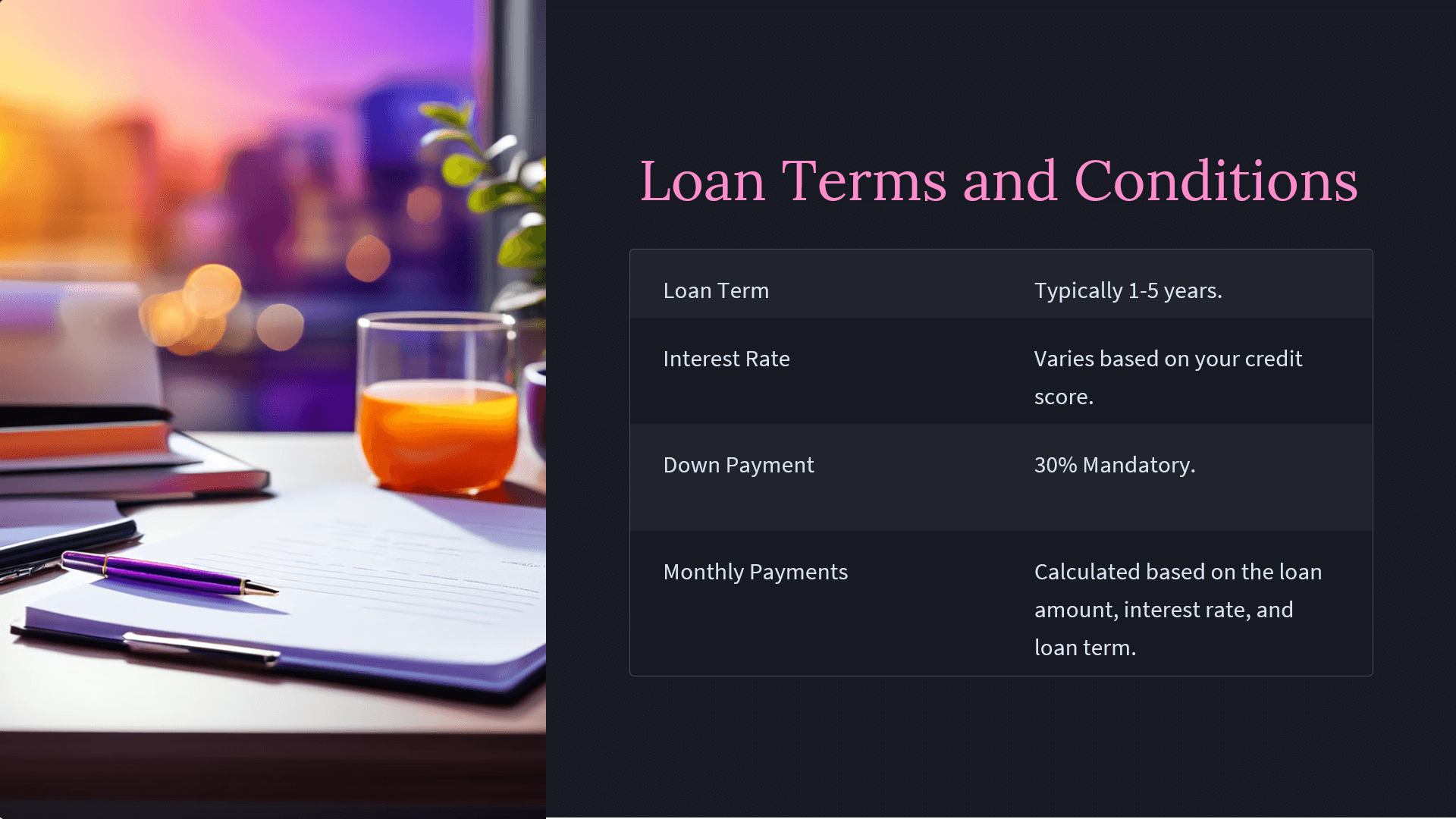

5. What is the interest rate on a solar loan?

Interest rates can vary based on the applicant’s credit score and income.

6. What loan terms are available?

Loan terms can range from 5 years to 20 years, depending on the lender and the loan amount.

7. Can I prepay my solar loan without penalties?

Many lenders allow prepayment, but it is important to check the specific terms and conditions of your loan agreement.

8. What happens if I sell my property before repaying the loan?

Options may include transferring the loan to the new property owner, paying off the remaining balance from the sale proceeds, or refinancing the loan.

9. Are there any government incentives for installing solar panels?

Yes, various federal, state, and local incentives are available, including tax credits, rebates, and grants. Check with your local government or tax advisor for more information.

10. What if the solar panels do not generate the expected amount of energy?

Most solar systems come with a performance warranty that guarantees a certain level of energy production. Additionally, regular maintenance and monitoring can ensure optimal performance.

11. Do I need insurance for my solar panels?

Yes, it is advisable to have insurance coverage to protect your solar panels against damage or theft. Check with your homeowner’s insurance provider for more information.

12. What is the difference between on-grid and off-grid models?

- On-grid model: This solar system is connected to the electricity grid. When your solar panels are not generating enough power, you can draw electricity from the grid. Additionally, when your solar panels produce excess power, you can sell it back to the grid.

- Off-grid model: This solar system is independent of the electricity grid and comes with a battery system. This model is ideal for areas where grid connection is unavailable or unreliable. Excess power is stored in batteries and can be used when needed.

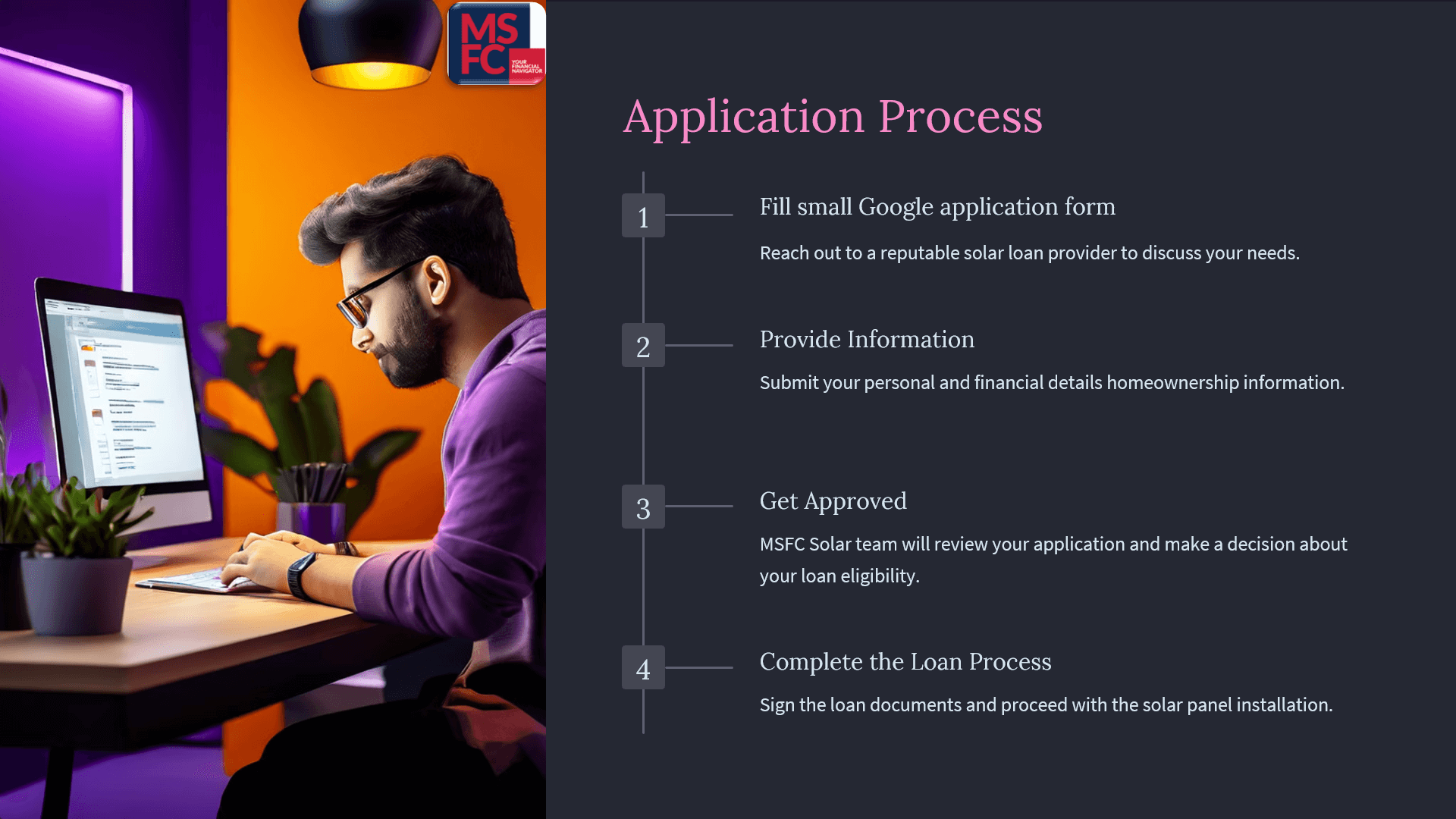

13. What is the process of installing solar panels with a solar loan?

- Site evaluation: A professional will assess the suitability of your property for solar panels.

- Design and quote: A custom solar system design is created, and a quote is provided.

- Loan approval: Secure financing through a solar loan.

- Installation: Qualified technicians install the solar panels on your property.

- Inspection and activation: The system is inspected and activated, allowing your solar power to start generating.

14. How can I maintain my solar panels?

Solar panels require minimal maintenance, but regular cleaning and periodic inspections can ensure they are working efficiently. Check with your installer for specific maintenance guidelines.